News

The Norlee Group acquires Tietjen Technologies, Inc.

Norlee, a portfolio company of White Wolf Capital Group (“White Wolf”) headquartered in Jacksonville, FL, announces the acquisition of Tietjen Technologies, Inc.

October 24, 2023 – The Norlee Group (“Norlee”), a portfolio company of White Wolf Capital Group (“White Wolf”) headquartered in Jacksonville, FL, announces the acquisition of Tietjen Technologies, Inc. (“Tietjen”). The investment in Tietjen was comprised of senior term debt. The additional capital provided by White Wolf allowed Norlee to complete the acquisition of Tietjen. Details of the transaction were not disclosed.

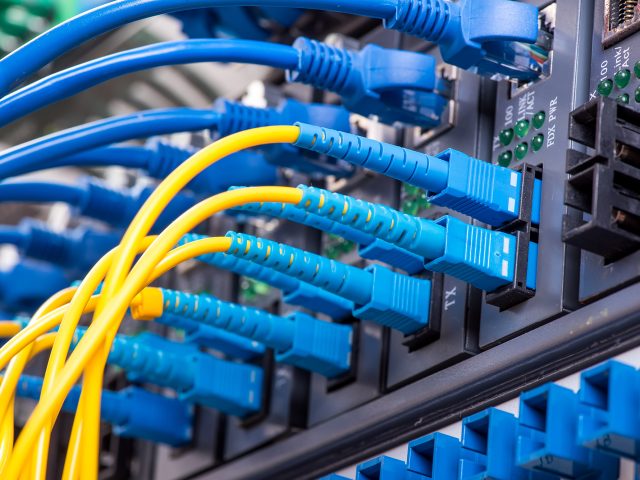

Based in Atlantic Beach, FL, Tietjen specializes in providing low voltage Structured Cabling, Fiber Optics, CCTV, and Building Automation. The addition of Tietjen to the Norlee platform adds a highly complementary engineering and installation scope of services.

Wally Budgell, President, and CEO (Chief Executive Officer) of The Norlee Group relayed “The Tietjen acquisition is our second closing in 90 days, and fourth in just over 2 years in Florida. It would not have been possible without the partnership we have with the White Wolf team.”

Judd Kohn, Managing Director, and Head of Enterprise Lending Solutions, White Wolf Private Credit, added “Tietjen is a natural fit with the Norlee Group’s business. The team at Tietjen will allow Norlee to offer a new set of services to its clients by providing exceptional customer service for their low voltage cabling needs.”

Cascade Partners served as the exclusive financial advisor to Norlee and provided buy-side advisory services.

About Norlee

The Norlee Group is a leading provider of electrical and specialty services focused on public works, industrial, commercial, underground, and multi-family projects across the US. Clients include all levels of government, general contractors, property developers, public and privately held corporations, and small businesses. For further information, please visit: https://norleegroup.com/.

About Cascade Partners

Cascade Partners is an investment banking, and private investment firm serving entrepreneurs, businesses, and investors active in the middle market by providing buy-side and sell-side M&A advisory services, outsourced corporate development, restructuring, and capital raising services.

For further information, please visit: www.cascade-partners.com.

About White Wolf Capital Group

White Wolf is a private investment firm that began operations in late 2011 and is focused on making direct and indirect investments in leading North American middle market companies.

In general, White Wolf seeks private equity and private credit investment opportunities in companies with $20 million to $200 million in revenues and up to $20 million in EBITDA. Typical situations include management buyouts, leveraged buyouts, recapitalizations, and investments for growth. Preferred industries include manufacturing, business services, government services, information technology, security, aerospace, and defense.

White Wolf also looks to invest with other private fund managers as a limited partner. In general, targeted investment candidates are North American focused private credit funds looking to raise $50 million to $500 million, with a focus on the lower-middle and middle-market.

For further information, please visit https://www.whitewolfcapital.com.

White Wolf’s office locations include Miami, Chicago, Montreal, and New York City.