News

White Wolf Capital invests in Hilco Plastics Holdings, LLC

August 15, 2012 - White Wolf Capital ("White Wolf") is pleased to announce an investment in Hilco Plastics Holdings, LLC ("Hilco"). White Wolf partnered with Gemini Investors ("Gemini") to recapitalize Hilco in partnership with the management team.

BlueWater Partners (www.bluewaterpartners.com) served as the exclusive financial advisor to Hilco.

About Hilco

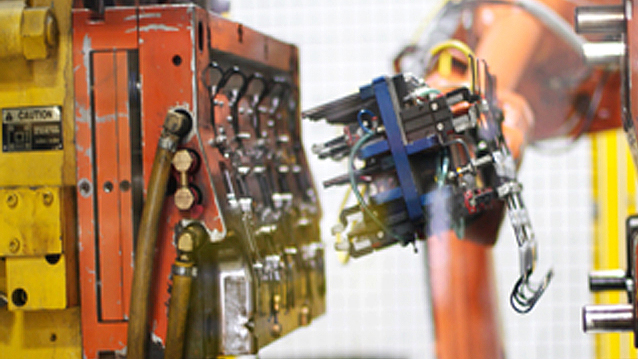

Using thermoplastic and gas-assist injection molding technology, Hilco manufactures, applies coatings to, and assembles plastic products for customers in the medical, automotive, furniture, marine and other end-markets. Hilco also applies abrasion resistant hard coat compositions and is one of the only UV curable, robotically sprayed, abrasion resistant hard coater in the U.S. Hilco was established in 1947 and manufactures product out of three plants in Michigan. For further information, please visit: www.hilcotech.com.

About Gemini

Founded in 1993, Gemini is a Massachusetts based private equity firm that provides capital and strategic resources to lower middle market companies. Gemini has a diversified approach to investing, and a proven track record in a variety of industries. Since its inception, Gemini has invested approximately $500 million in more than 90 companies throughout the U.S., typically investing $3 million to $8 million per transaction in either control or minority positions. Gemini’s target portfolio company has revenues of $10 million to $50 million and EBITDA of at least $1 million. For further information, please visit: www.gemini-investors.com.

About White Wolf

White Wolf is a private investment firm that began operations in late 2011 and is focused on making direct and indirect investments in leading North American middle market companies.

White Wolf seeks private equity and private credit investment opportunities in companies with $20 million to $200 million in revenues and up to $20 million in EBITDA. Typical situations include management buyouts, leveraged buyouts, recapitalizations, and investments for growth. Preferred industries include manufacturing, business services, government services, information technology, security, aerospace, and defense.

White Wolf also looks to invest with other private fund managers as a limited partner. Targeted investment candidates are North American focused private credit funds looking to raise $50 million to $500 million, with a focus on the lower-middle and middle-market.

White Wolf’s office locations include Miami, Chicago, Montreal, and New York City.

For further information, please visit www.whitewolfcapital.com.